Mortgage Bankers Association is forecasting that we will see a three-year-high in mortgage originations since 2016. In 2016 the industry saw $2 trillion and in 2019 MBA is predicting that we will land around $1.9 trillion.

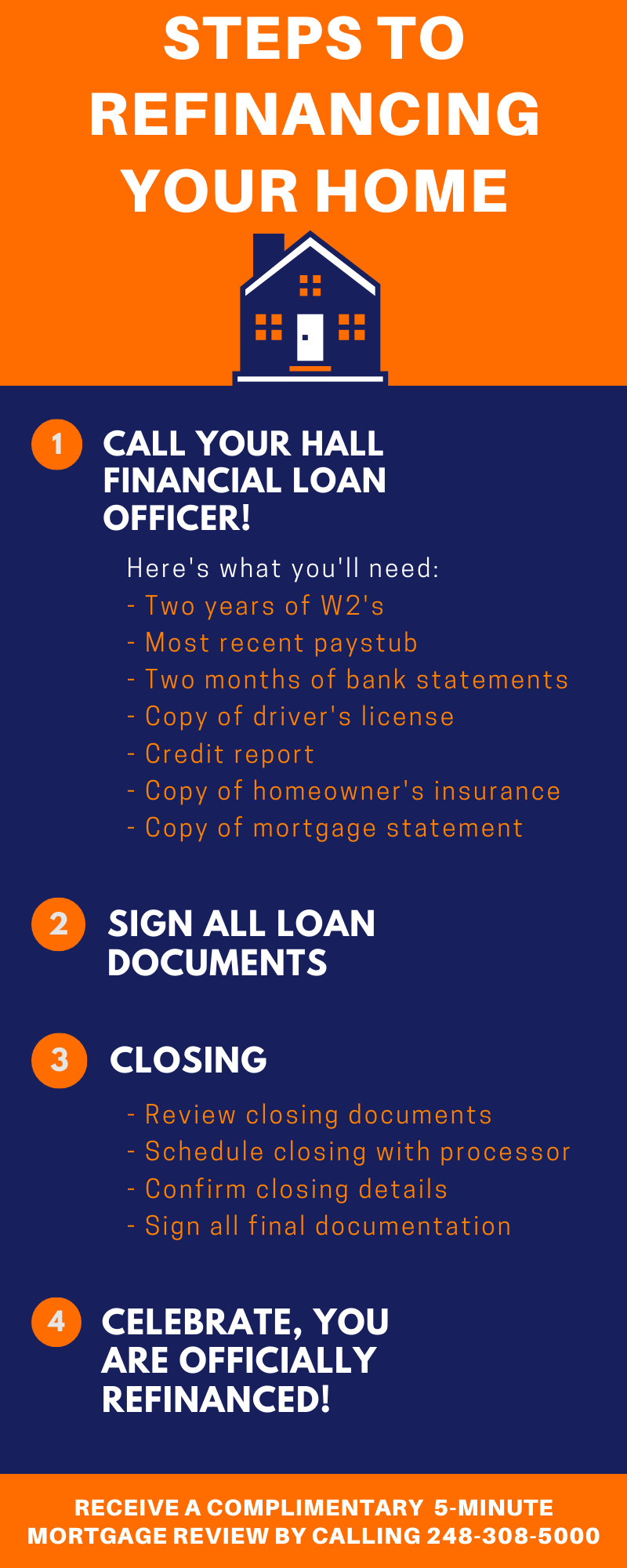

Since the FED cut rates not once, but twice this year we have seen an increase in refinances. MBA is predicting that 35% of that $1.9 trillion will be attributed to those refinancing; which reflects Fannie Mae’s projection of refinances also being at a three-year-high.

If you are someone who follows along and have been on the fence about refinancing keep in mind that your credit score will affect the rate you get locked in to. The industry has been seeing a wide range of interest rates for credit scores of 620 through 639; anywhere around 1.33% in difference. However, if you can, you can buy down your interest rate.

Not sure what buying an interest rate means? Click here to talk to someone today!

In other news, we have been seeing an increase in home prices. Before, you cringe right now this news is good. With rates remaining low you still have the ability to get more house than you may have planned for and we are seeing an increase in inventory. Right now Detroit is sitting in the top six areas at 4.1% in year-over-year strength.