Is Buying a Home a Good Investment?

Whether the prodigal spender, the frugal financial enthusiast, or somewhere in between, having a place to call home is a must. With rent prices relentlessly on the rise and the housing market red-hot, many consumers find themselves asking if buying is a good investment.

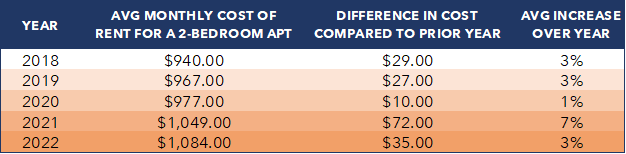

Renters have felt the burn of soaring prices over the past 3 years, with high suspicion the costs will continue to rise. During the years of 2017 to 2019, rent prices of a two-bedroom apartment in the Metro Detroit area averaged increases between 1-3%. Over the past 2 years, rent prices in the Metro Detroit area averaged increases between 3-7%.

Information referenced from https://www.rentdata.org/detroit-warren-livonia-mi-hud-metro-fmr-area/2022

The argument of renting a home keeping more money in your pocket may be a claim of the past. Many renters contend that while purchasing a home can be an investment, the cost of maintenance and taxes alone offset the benefits. Many opt for renting and inject funds into more liquid investing options, such as the stock market, as they feel it will provide them with higher rates of return. However, many rental property owners have the tendency to raise rental rates to keep up with inflation. The funds that once were available to invest in stocks may now need to be allocated to the rising cost of rent, leaving even less for alternate investing opportunities.

Many on-the-fence consumers are attributing their lack of desire to purchase to the housing market which is coined a seller’s market and increasing interest rates, comparative to last year. On the flip side, financing properties with fixed rate loans allows for costs to stay consistent in times of economic strain. Keep in mind, today’s average value of a two-bedroom home for purchase in the Metro Detroit area is $238,000. A 30-year fixed rate mortgage would place the monthly payment at approximately $1,350. I know what you’re thinking – What does this mean? The monthly cost appears to be greater to buy rather than rent… The difference-maker – consumers who decide to opt into purchasing a home could technically have more static expenses over time compared to those who rent as rental rates historically have risen. Another truth of the matter, no matter where interests rates are, renting is 100% interest. While purchasing a home poses the potential of earning returns, the returns on renting continue to be ambiguous or non-existent.

Now that we’ve put past details into perspective, let’s discuss what purchasing a home could mean for the future. Purchasing a home unlocks many investing doors for buyers. Home values in Metro Detroit have appreciated, on average, 15% compared to last year and are projected to continue to grow. Leveraging the equity in a home could allow the purchaser to diversify their portfolio and earn passive income. One example, some owners consider refinancing with intentions of using the funds to purchase a second property as a rental. The rental property is an investment that’s protected against inflation, as rental rates could be adjusted while the cost of the mortgage is consistent. It’s time to build equity!

Experts say that investing is a long-term game. With the value of homes and rent prices consistently on the rise, waiting for the right time to purchase a home is becoming more of a gamble.

For more information, chat with us at callhallfirst.com or give us a call at 866-Call-Hall.