What Credit Score Do I Need for a House?

When buying a house as with most large purchases your credit score plays an integral part in determining what you may qualify for when buying a home and needing a mortgage. This article will explain the minimum credit score requirements.

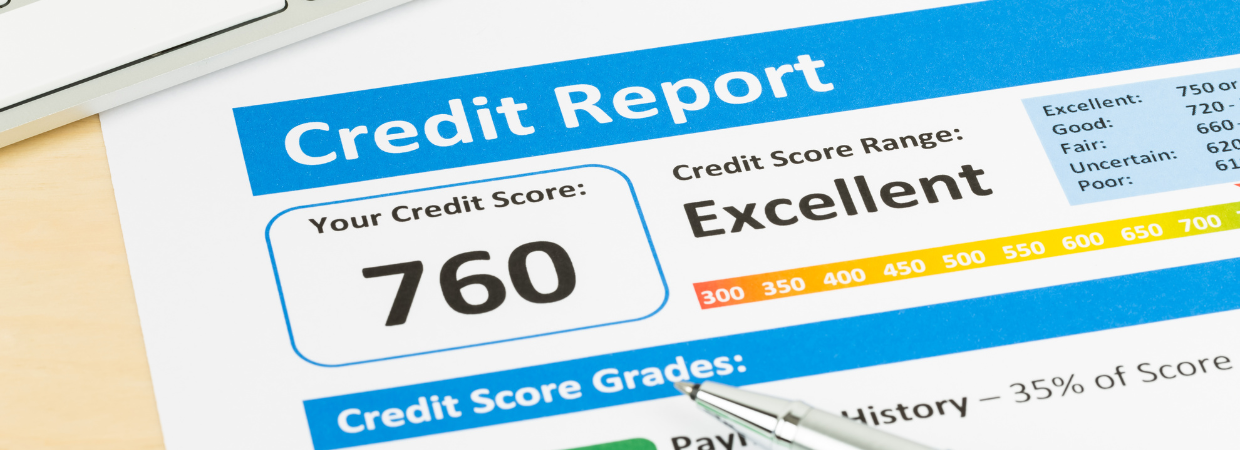

Mortgage companies are required to pull your credit report from 3 of the largest credit bureaus – TransUnion, Equifax and Experian. Each one will provide a score between 300 (Lowest) – 850 (Highest). A mortgage lender will use the middle of these three scores as the qualifying credit score.

Typically, any score over 740 is considered excellent while a score between 680 – 739 being very good. Most mortgage lenders who originate and close FHA and Conventional mortgages typically will require a minimum score of 620. Some lenders are able to accept scores of 580 – 619 for FHA mortgages though these are viewed to be riskier.

It is always best to consult with your Home Loan Advisor at Hall Financial to review your circumstances and will advise you on what your options may be.